Cyber or Online fraud is an increasing threat in India, affecting individuals and businesses alike. If you’ve been a victim of online fraud—whether it’s a phishing scam, identity theft, financial fraud, or any other cybercrime—it’s crucial to report it promptly.

This guide will walk you through the steps on how to report cyber or online fraud in India, along with tips for gathering evidence and staying safe.

1. Gather All Relevant Information

Before you file a report, collect as much information as possible related to the fraud. Here are the details you should gather:

- Time and date of the incident

- Screenshots of messages, emails, or websites involved

- Transaction details (if any financial loss occurred)

- Your contact information

- Copies of any IDs or documents that may have been misused

Having all this information ready will make the reporting process smoother and give law enforcement a better chance of tracking down the perpetrators.

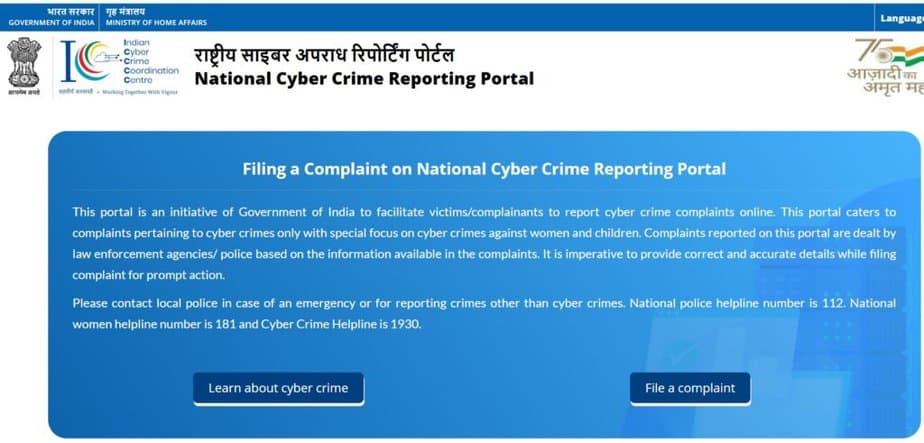

2. Report the Cyber Fraud to the National Cyber Crime Reporting Portal

India has a dedicated National Cyber Crime Reporting Portal where citizens can report cybercrimes, including financial fraud, online harassment, social media abuse, and more.

How to Report on the Cyber Crime Reporting Portal:

1. Visit the National Cyber Crime Reporting Portal: Go to cybercrime.gov.in.

2. Select ‘File a Complaint’: On the homepage, click on “Report Other Cyber Crime.” click on “File a Complaint” and click on “I Accept”

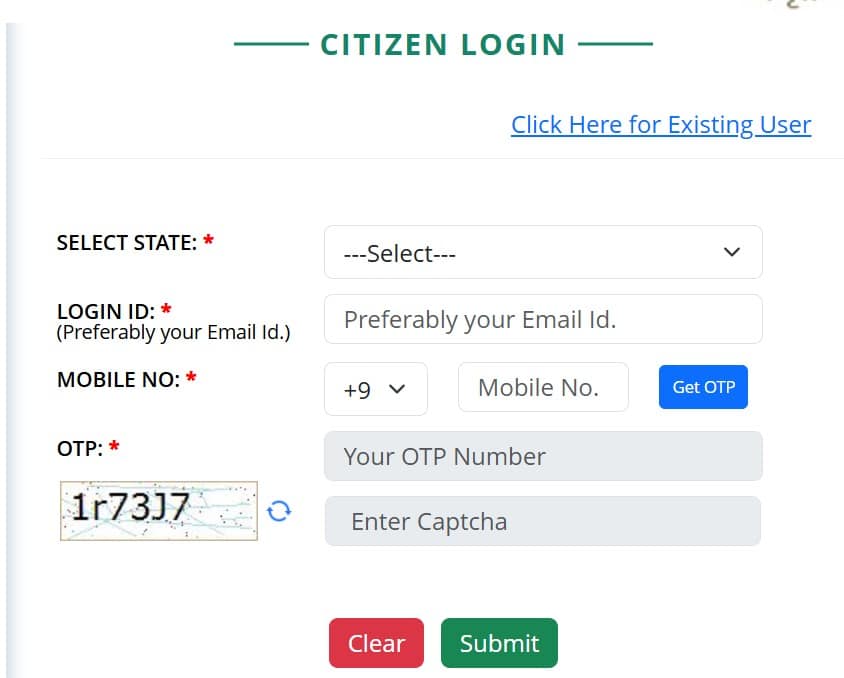

3. Register an Account: You’ll be asked to create an account if you don’t have one. Enter your mobile number, name, and other details to register.

4. Authenticate on the Portal: Select your state and phone number. You will need to authenticate with OTP

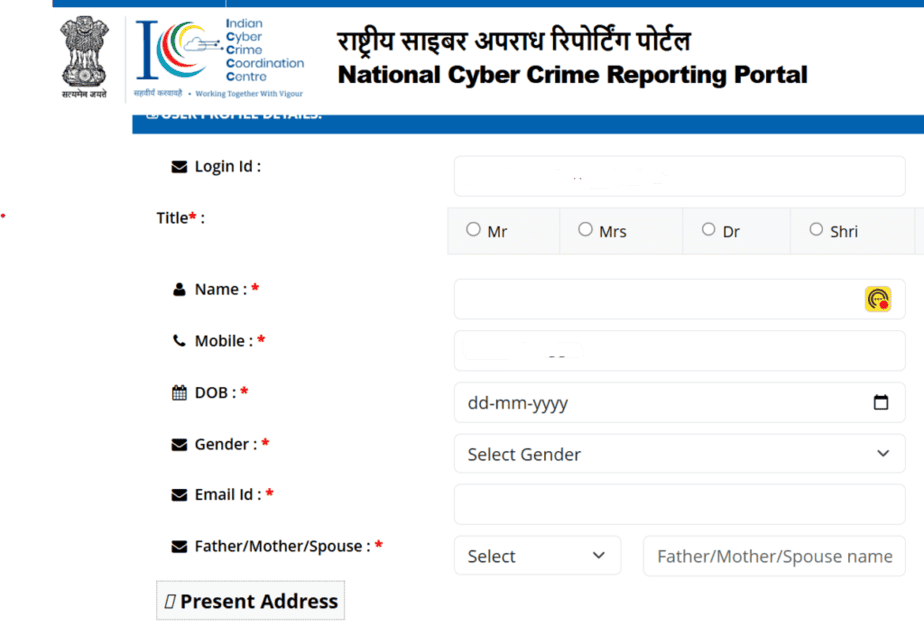

5. Complete the Form: Fill in the complaint form with details about the incident, providing as much information as possible. Update your details and Address and follow the instructions.

6. Upload Documents: Attach any supporting evidence, such as screenshots, transaction slips, or chat history.

7. Submit the Report: Once you’ve completed all fields, submit your complaint. You will receive an acknowledgment number for tracking your report.

3. Contact Your Nearest Cyber Crime Police Station

If you prefer in-person reporting or need immediate assistance, you can visit your nearest Cyber Crime Police Station. Most cities in India have dedicated cybercrime cells equipped to handle cases of online fraud and cybercrime.

What to Expect at the Cyber Crime Police Station:

- Filing a First Information Report (FIR): If the fraud has resulted in financial loss or serious harm, you should file an FIR. In India, police must register an FIR for serious cyber offenses.

- Document Submission: Bring copies of all the evidence and documents you’ve gathered. Make sure to bring originals as well in case they need verification.

- Receive a Copy of the FIR: Keep a copy of the FIR for your records, as it is essential for tracking the progress of your case.

4. Notify Your Bank or Financial Institution (For Financial Fraud)

If the fraud involves unauthorized financial transactions, notify your bank or financial institution immediately. Quick action may help prevent further losses or even allow your bank to recover the funds.

Steps to Take:

- Contact Customer Support: Call your bank’s customer support line and report the unauthorized transaction.

- Block Your Card or Account (if necessary): For severe cases of fraud, request to block your card or temporarily freeze your account.

- Submit a Written Complaint: In most cases, the bank will ask you to submit a written complaint or fill out a form describing the incident.

- Follow Up with the Bank’s Fraud Department: Stay in contact with the fraud department for updates on the status of your report.

5. Report to the Reserve Bank of India (For Financial Frauds)

If the fraud involves a bank or financial institution, and you’re unsatisfied with the response or recovery efforts, you can escalate the complaint to the Reserve Bank of India (RBI). The RBI has an Ombudsman scheme that assists with complaints against banks.

How to File a Complaint with the RBI:

- Visit the RBI’s Complaint Portal: Go to the RBI Complaint Management System.

- Register a Complaint: Follow the instructions to file a complaint against your bank or financial institution. Include all details about the fraud and prior correspondence with the bank.

- Submit Supporting Documents: Attach any evidence, including correspondence with the bank, transaction details, and police reports if available.

6. Report Cyber Frauds on Social Media Platforms (If Applicable)

If the fraud occurred on social media (such as fake accounts, hacking, or harassment), you should also report it on the platform itself. Facebook, Instagram, Twitter, and other platforms have reporting tools for handling scams, fake accounts, and abusive content.

Reporting Fraud on Social Media Platforms:

- Visit the Help or Support Section: Each platform has a dedicated help or support section for reporting fraud.

- Describe the Incident: Provide as much detail as possible, including usernames, dates, and screenshots if available.

- Follow Up on the Case: Check your email or platform notifications for any updates or actions taken.

7. Use the Cyber Swachhta Kendra for Self-Protection

The Indian government has launched Cyber Swachhta Kendra (Cyber Hygiene Centre) to promote safer online practices and provide tools for malware removal. It offers free tools to check for malware infections and clean your devices.

- Visit the Cyber Swachhta Kendra website: Go to cyberswachhtakendra.gov.in to access tools and guidelines on keeping your devices secure.

8. Additional Tips: Protect Yourself from Future Cyber Frauds

- Enable Two-Factor Authentication: Adding an extra layer of security to your online accounts can prevent unauthorized access.

- Beware of Phishing Scams: Be cautious with unsolicited emails, messages, or calls requesting personal information.

- Regularly Monitor Accounts: Regularly check your bank and social media accounts for unusual activity.

- Keep Your Software Updated: Ensure your devices and software are up-to-date to prevent vulnerabilities.

Conclusion

Reporting cyber fraud in India may feel daunting, but these steps make the process straightforward. Taking prompt action is crucial not only for recovering potential losses but also for preventing these criminals from targeting others. Remember, every report counts in the fight against cybercrime. Stay alert, stay safe, and if you suspect anything suspicious, report it right away!

Leave a Reply